Want to improve your home, boost its energy efficiency and save money?

Introduced last year, the Inflation Reduction Act of 2022 ([Ira](https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/19/fact-sheet-the-inflation-reduction-act-supports-workers-and-families/#:~:text=The%20Inflation%20Reduction%20Act%20lowers%20prescription%20drug%20costs%2C,and%20create%20good-paying%2C%20union%20jobs%20across%20the%20country. target=)) can help homeowners do all three and more. The Ira is the U.S. government’s largest climate investment initiative in American history. Signed into law in August 2022, the act is projected to reduce greenhouse gas (Gh) by 31% to 44% below 2005 levels by 2030.

The Ira can help homeowners like you improve your home’s comfort, boost its energy efficiency and save money. In fact, the Ira is a game- and climate-changer for the better.

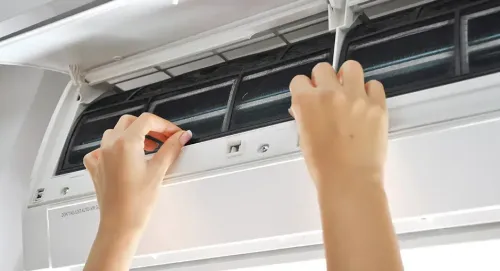

For instance, by upgrading a conventional HVAC system to a high-efficiency, all-climate heat pump, homeowners can save thousands of dollars over the next decade. Let’s dive deeper into ways qualified homeowners may benefit from the Ira.

Energy Efficient Home Improvement (25C) Tax Credit

Under the Energy Efficiency Home Improvement program and according to section 25C of the U.S. tax code, homeowners are eligible for a tax credit of 30% of the cost, up to $2,000, for high-efficiency heat pumps and/or heat pump water heaters and other equipment. Only certain models qualify for the tax credit, and you must have a tax liability from which to reduce your taxes.

If taking advantage of this part of the Ira, you’ll be able to get credit on this year’s taxes and annually through Dec. 31, 2032. The net-net? Homeowners like you can get tax credits every year starting now for ten years.

Along with installing a qualified heat pump or heat pump water heater, homeowners can get up to $600 per item for breaker panels, insulation and fossil-fuel systems meeting elevated efficiency limits – with a maximum $1,200 tax credit.

Homes Rebate Program

Under the Homes Rebate Program, single and multifamily homes fall under three rebate levels. Homes with a:

- 20% energy reduction can get a $2,000 maximum rebate or half the cost of a retrofit project – whichever is less.

- 35% energy reduction can collect a $4,000 maximum rebate.

- 35% energy reduction and qualifying as low-income (less than 80% of local median income) are eligible for an $8,000-max rebate.

There’s a caveat: Rebates vary by the state you live in since this provision of the Ira is set by state energy offices.

Go clean and green with a modern-day, all-climate heat pump

Environmentally friendly homeowners like you can do your part in the green movement and save some green while doing so through these new initiatives. Consider switching your HVAC out for a modern, all-climate heat pump from Mitsubishi Electric.

Whereas a conventional system burns fossil fuels, a Mitsubishi Electric all-climate heat pump circulates filtered air – while removing pollutants, allergens, bacteria, smoke and odors from your home – with no fossil fuels. Today’s heat pumps will lower your energy bill without adding emissions to the atmosphere.

Plus, the new law makes purchasing a heat pump more affordable than ever and helps reduce your carbon footprint. Additional heat pump advantages include the benefits of the inverter to help ensure consistent room temperature, just-as-needed energy consumption, quick heat-up and steady energy usage.

So, while it might not be easy to be green, the federal government is providing homeowners like you with incentives for doing so.

By making improvements to your home and going green, you can help reduce your carbon footprint, increase energy efficiency in your home and be a better global citizen.